આજે કેન્દ્રીય નાણામંત્રી બજેટ 2021-22 ની જાહેરાત કરશે.

👉 શુ કરી નવી જાહેરાત ??

👉🏻 Tax મા શું રાહત મળશે ??

👉🏿 કઈ નવી યોજનાઓની જાહેરાત કરી. ??

જાણો આજના બજેટમાં વિવિધ વિભાગો માટે શું જાહેર કરવામાં આવ્યું❓

ખેડૂતો

એજ્યુકેશન

ગરીબો માટે

ઈન્સ્યોરન્સ અને બેન્કિંગ સેક્ટર

હેલ્થ

ઈન્ફ્રાસ્ટ્રકચર

રેલવે

ઇન્કમ ટેક્સ, અને બજેટ મા કઇ કઇ વાતો કરવામાં આવી તેની વિસ્તૃત માહિતી

Union budget 2021-22 See who gets how much tax exemption

Your Query

#Income Tax Slab 2021-22 Live Updates:

#New Income Tax Slabs and Rates in India,

#Revised Income Tax Slabs for FY 2021-22,

#Covid Cess in Budget 2021 Live

◆ Download Budget Speech English

◆ Download Budget Speech Hindi

Resident and non-resident Indians

Applicable income threshold tax rate :

- up to Nil up to 2,50,000

- 2,50,000 to 5,00,000 5%

- 5,00,000 to ₹ 10,00,000 20%

- 30% more than 10.00,000

LTCG tax on capital investment: Stock market in long-term investment on the biggest change in capital gains tax revenues this fiscal year will be implemented

Standard Deductions: Budget announced a standard deduction of Rs 40,000 for salaried employees, but 19.200 has been deducted from tax-free medical returns and annual alignment of Rs.15,000. Rs. The difference of 5,800 is decreasing.

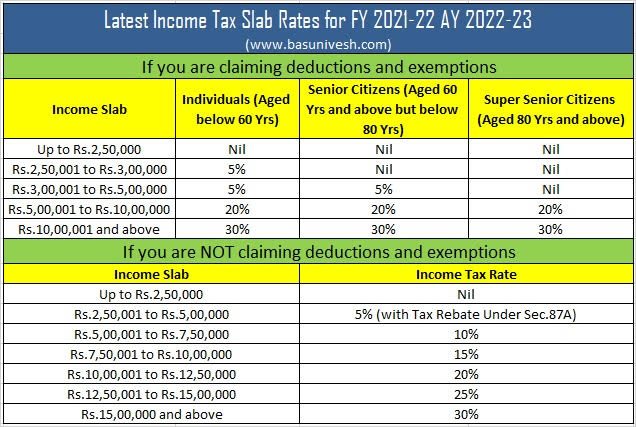

Latest Income Tax Slab Rates for FY 2021-22 AY 2022-23 | If you are claiming deductions and exemptions

--

--

--

--

--

--

--

--

This application provides all the necessary calculators and is ready for printing for self-assessment of income of salaried employees in Gujarat state. This application is very easy to use always. You can get complete information on income tax and instructions for using the application. All you have to do is fill in the salary details, other income and deductible data sheet. All tax calculations and forms will be generated automatically. You can get the impression of self-assessment form, Form 16 and payroll for employment.

● આ પણ જુઓ : ઇન્કમટેક્ષ ઓનલાઇન કેલ્ક્યુલેટર

Amendments for the Accounting Year 2020-21:

The main improvement for this year is the new tax structure. But you can also pay income tax by calculating according to the old tax structure (calculated year 2019-20). You can take advantage of this by calculating both income tax structure templates. Once you have completed all the details of the application, then you have calculated and indicated the amount of income tax, for both the format and the constitution. The advantage you will get is that you can get a printout of the form as per the constitution.

New tax structure:

In the new tax structure you are given some additional new tax slabs for this year. But you will not get the benefit of deduction. According to the new and old tax structures, the income tax rates are as follows.

Other information:

- In the new and old tax structure, according to Article 87, taxable income is less than Rs. 5.00.000 / - up to 100% of total income tax. 12,500 / - Why less income is deducted system.

- Option to select new and old tax structures Section: 115 B.A.C. As explained below, a taxpayer without a business or business income may choose another option when the option or business income taxpayer submits an annual income tax return until the taxpayer changes. New Then born. Except in the future, when the taxpayer's business income is not significant, he will have the right to choose another option every year..

- If the old scheme is selected then all the existing tax exemptions for new tax, deductions and reliefs will be availed and if the new scheme is selected then the benefit of fixed deduction policy, tax exemption as well as set off of losses will not be availed.

You can print This new Form and fill up a useful Gujarati application, Incometax form for this purpose. You can use this application very easily. You can See his explanation

Here You can easily use the app to download the new PDF file for instructions on how to use the app. You can download the PDF file and application at the following link given below. Useful information for all employees

● આ પણ જુઓ : ઇન્કમટેક્ષ આકારણી ૫ત્રક વર્ષ 2020-21 (ઓટોમેટિક એક્ષલ ફાઈલ અને PDF)

Latest Income Tax Slab Rates for FY 2021-22 AY 2022-23 ( www.basunivesh.com ) If you are claiming deductions and exemptions

● VEHICLE SCREPAGE POLICY CLICK HERE