Why does the government not reduce the price of petrol and diesel? This is a common question. In such a situation, it is also important to know how the prices of petrol and diesel are decided.

મહત્વપૂર્ણ લિંક

State-owned oil companies on Wednesday cut the prices of petrol and diesel by one paise per liter. Petrol and diesel prices have never been so high in the last four years, and the reason for the rise in prices is the government tax on oil prices.

There is pressure on the government to reduce the price of petrol and diesel, but there are two reasons for this increase - first the rising price of crude oil and secondly the weakening of the rupee against the dollar, but the biggest reason is the government tax on the price of petrol and diesel.

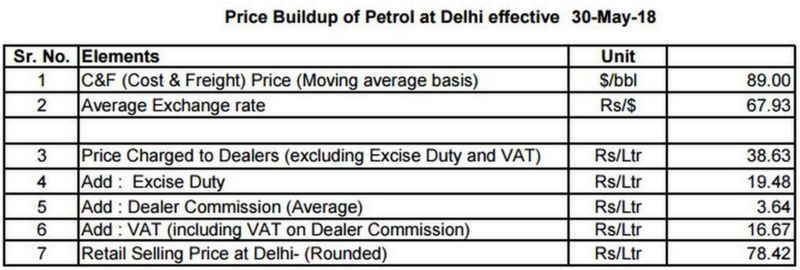

The price of a liter of petrol in Delhi on Wednesday is Rs 78.42, in which the tax component is Rs 35.89. That is, by the time petrol reaches the consumer, 95% tax is added to its original price.

How is the price of crude oil determined?

The price of crude oil reached 89 89 per barrel. In other words, the price of a barrel of crude oil has gone up to Rs 6,045.77. The price of crude oil has gone up to Rs 38.02 per liter at 159 liters per barrel.

Now the cost of bringing oil to India after purchase is paid, after coming to India it is the cost of transporting it to refineries (companies like IOC, BPCL). The company then processes it and delivers it to the dealers (petrol pumps) in the form of petrol or diesel. Where the excise duty of the central government, VAT of the state government and commission of the dealer are linked to it.

What is the share of one liter of petrol?

However, when petrol reaches the dealer, it costs Rs 38.63 per litre. On which the central government levies an excise duty of Rs 19.48 and the dealer adds his commission (Rs 3.64 in Delhi), the state governments levy VAT (in Maharashtra 46.52 per cent, in Kerala 34 per cent, in Goa 17 per cent).

On 23 May, VAT was imposed on petrol in Delhi at Rs 16.41. Thus, 95 per cent of the price is taxable.

In the last few days, the price of petrol has increased by Rs 2.54, which is the most expensive in the last four years.

After deregulation of petrol in June 2010 and diesel in October 2014, prices have changed twice a month. But since June 16, 2017, the price of petrol and diesel in the country is changing daily. But for the first time before the Karnataka assembly elections, the daily price change was banned for 20 days. The price did not change for 20 days but as soon as the control was lifted, the prices of petrol and diesel reached a record level.

international market for oil

The government is blaming the rise in international crude oil prices for the rising petrol prices in the country. Apart from this, the rupee has depreciated against the dollar for 16 months (Rs 67.93 per dollar) and this is affecting the buying of oil.

However, the heavy tax imposed by the central and state governments on petrol and diesel across the country is the biggest reason for the hike in petrol-diesel prices.

Oil expert Narendra Taneja says that the tax is almost the same as the price of oil.

Find out why petrol prices have risen and how petrol and diesel prices are determined.

“After buying crude oil, it is brought to the refinery and comes out at the gate in the form of petrol and diesel, then it is taxed,” he said. First the central government levies excise duty.

“The government then levies a tax, called sales tax or VAT, on trucks going into the state. Along with this, the petrol pump dealer takes a commission on it. It is almost 100 per cent tax.

Will it be cheaper to bring petrol under the ambit of GST?

Due to the ever-increasing price of petrol, it is now being demanded under GST. Natural gas, crude oil, petrol, diesel and aviation fuel were excluded from the purview of GST imposed in 2017.

The fall in GST is expected to bring down the prices of petrol and diesel. This is because GST will be applicable instead of separate taxes levied by the central and state governments.

According to experts, if 18 percent GST is imposed on petroleum producers, then the price of petrol in Delhi will come down to Rs 48.71 per liter.

What is so important about the alcoholic beverage launched by Coca-Cola?

What is the truth of the allegations against Paytm?

In such a situation, it is believed that even if it is brought under the purview of GST, it will be kept in the 28 percent slab only. At the same time, the central and state governments will be given the right to levy separate cess to compensate for the loss.

If GST is levied on petrol, then the price in Delhi will be Rs 54 per liter.

Oil purchases and international situation

India imports 80 per cent of its crude oil to meet the demand. In April 2018, India bought 4.51 million barrels of crude oil, an increase of 2.5 per cent over the previous year.

Most of the petrol and diesel imports in India come from West Asian countries and are currently volatile.

Iraq is now a major importer of crude oil from India, which has traditionally pushed India's largest supplier Saudi Arabia to the second position during January-April 2018.

Iran ranks third, with India buying 640,000 barrels of crude oil per day in April. India is the second largest importer of oil from Iran after China.

US Secretary of State Mike Pompeo has said that the US will impose the most stringent sanctions on Iran, if this happens, Iran will have to fight to maintain its economy.

Despite the fall in international crude oil prices per barrel, the prices of petrol and diesel in India are higher as compared to other countries. This worries the drivers. The general public is also troubled by the economic burden as the prices of many other commodities have also gone up.

According to experts, petrol is like liquid gold for the governments. That's why they have kept fuel out of GST. The daily increase in the prices of petrol and diesel is like an ATM machine for the governments.

Like gold, silver or dollar, now the price of petrol and diesel changes every day.

Why are petrol prices so high in India?: Central government has imposed excise duty and state governments have levied VAT on top which is much higher than the maximum slab of 28 per cent GST. The government argues that higher taxes are necessary to raise funds for public works and infrastructure development, but the rise in the prices of petroleum products also places a financial burden on the common people as the prices of other commodities rise.

The world came to a standstill during the Kovid-19 pandemic and recession spread everywhere but you would be surprised to know that Corona also saw a huge drop in all types of excise duty collection, while Central Excise duty saw a huge increase of 48% this year . The reason for this is the increase in the prices of products on diesel and petrol.

In the midst of inflation, the general public is facing another setback. Petrol and diesel prices have once again jumped. Petrol has increased by 14 percent and diesel by 12 percent in 9 months. Petrol-diesel has crossed Rs 80 in Ahmedabad. Today the price of petrol in Ahmedabad is Rs 82.51 per liter and the price of diesel is Rs 81.14.

According to CAG data, there was a huge increase in excise duty in April-November 2020 as compared to the year 2019. Excise duty collection in the year 2019 was Rs 1 lakh 32 thousand 899 crore, which increased to Rs 1 lakh 96 thousand 342 crore in the year 2020. Surprisingly, excise duty has gone up despite a drop of more than one trillion tonnes in diesel sales in eight months.

Base price of petrol is very low

Petrol and diesel prices have been skyrocketing in the last few months. And its price is skyrocketing at the moment. The blow is falling on the pocket of the common man. When you buy one liter of petrol and diesel, it includes excise duty, dealer commission and value added tax (VAT). That is, the price of petrol is fixed by adding excise duty, dealer commission and VAT.

Petrol-Diesel GST abolished

Diesel is the most widely used fuel in India. According to the Petroleum Planning and Analysis Cell (PPAC), diesel sales for the period April-November 2020 stood at 5.54 million tonnes from 44.9 million tonnes in the previous year 2019. Petrol sales also declined by 204 million tonnes during the same period to 174 million tonnes. Petroleum products and natural gas are exempted from GST. GST law is applicable in the country from July 2017.

Excise duty increased twice a year

The government has increased the excise duty on petrol by two times during the current financial year.

Excise duty hiked by Rs 13 on petrol and Rs 16 per liter on diesel

Excise duty on petrol has been increased to Rs 32.98 per liter

Diesel has become Rs 31.83 per liter

Excise duty collection in the financial year 2019-20 stood at 2 lakh 39 thousand 599 crore

How do petrol and diesel prices rise?

Price doubles after adding excise duty, dealer commission and other items

Center levies excise duty on petroleum products and natural gas

State governments levy VAT

Relief comes when state governments remove excise duty and VAT

If excise duty and VAT are removed, the rate of diesel and petrol will be around Rs 27

Petrol-diesel is a major source of revenue

Neither the central nor the state government withdraws the tax at any cost.

Alphonso, who was a minister in the Modi government, has also added fuel to the fire by making controversial statements. He has insulted the public by saying that paying more for fuel will not leave them hungry. Those who can afford it will have to pay a higher price.

During 2004-2014, when the UPA government was in power, international crude oil prices were in the range of ₹100-150 per barrel. As a result, petrol prices in India went up by Rs 30-70.

Now (since 2014) when BJP government is in power, crude oil prices have come down to 30-50 per barrel, but it has proved beneficial for the present government.

The reason behind the increase in the prices of petrol and diesel in India is that the government has reduced the price of fuel and increased the central excise duty manifold instead of passing on the benefits to the general public. This has had a detrimental effect on the tax structure and has also increased the state tax level. In short, the general public is paying twice the cost of fuel in the present BJP government as compared to the previous UPA government. Government companies have a monopoly market.

How much will the cost be?

The Government of India has the option to reduce the excise duty on petrol and diesel. The central government has imposed excise duty of Rs 19.48 per liter on petrol and Rs 15.33 per liter on diesel. Whereas VAT rates vary from state to state.

This means a tax cut to bring down petrol prices, but economists believe the tax cut could have a negative impact on government revenue and the public exchequer.

Why is India selling petrol at Rs 25 more than Pakistan?

Why has the price of petrol and diesel increased so much?

State Bank of India (SBI) has said that the recent rise in crude oil prices will impact the country's exports and the CAD could rise to 2.5 per cent of GDP.

In SBI's ECORAP report, economist Soumya Kanti Ghosh estimates that a 10 per barrel increase in crude oil will add 8 billion to the country's import bill.

This leads to an increase in the GDP of 16 base figure i.e. bps. This results in an increase of eight bps in the fiscal deficit, 27 bps in the current account and 30 bps in inflation. However, there may be a difference between this estimate and the actual increase.